will long term capital gains tax change in 2021

Theyre taxed at lower rates than short. They are generally lower than short-term capital gains tax rates.

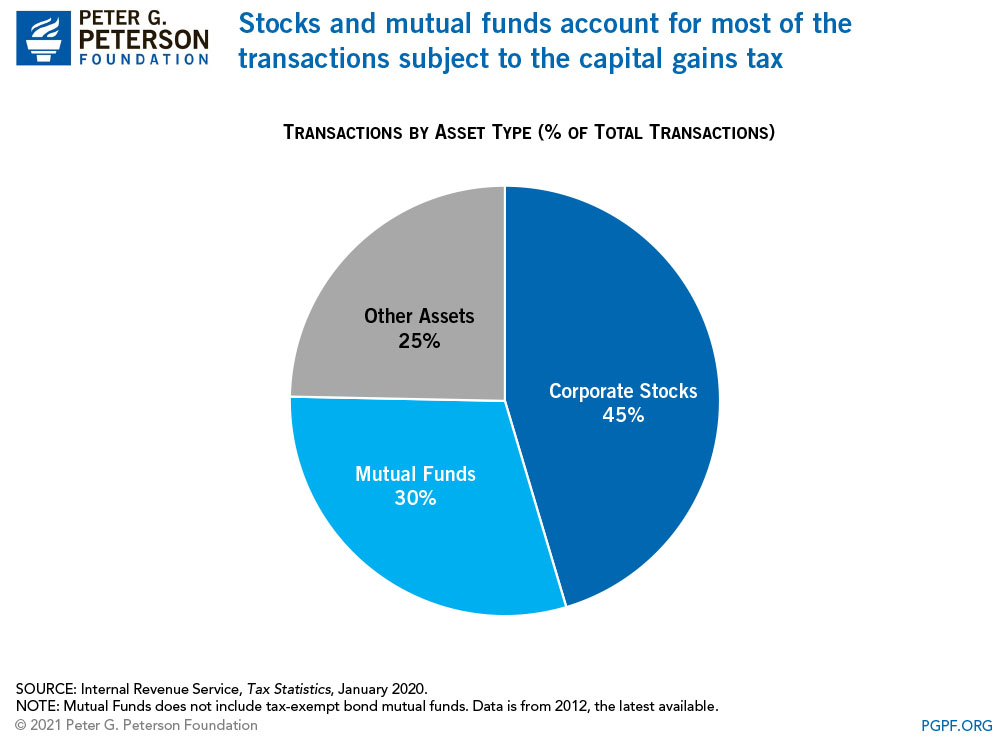

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the.

. Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. That means you pay the same tax rates you pay on federal income tax. Key Points President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20.

If you have the asset for a year or less it. Long-term capital gains are incurred on appreciated assets sold after. For years 2021 and 2022 though it stayed the same.

4 rows Additionally the proposal would impose a 3 surtax on modified adjusted gross income over. Limit on the Deduction and Carryover of Losses If your capital losses. 35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for.

For the tax years 2021 and 2022 long-term capital gains are taxed at 0 15 or 20 depending on the income of the filer. The current capital gain tax rate for wealthy investors is 20. The tax hike would apply to households making more than 1.

It also includes income thresholds for Bidens top rate proposal and the 38. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Long-term capital gains are gains on assets you hold for more than one year.

Rather they are adjusted each year to reflect inflation. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status.

What is the Capital Gains Tax Rate When Selling a Home. The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20. There are two main categories for capital gains.

2022 Long-Term Capital Gains Tax Rates The tax brackets are not permanently fixed at one income threshold. Long-term Capital Gains Tax Rates For Rental Property Investors. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term.

The capital gains tax rate is 0 15 or 20 on most assets that are held for longer than a year. However it was struck down in March 2022. May 11 2021 800 AM EDT.

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Capital Gains Tax Minimum Wage Increase Among New Laws Taking Effect In 2022 Mynorthwest Com

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

How Are Capital Gains Taxed Tax Policy Center

Schedule Cg Capital Gain For Returns Of Ay 2020 2021

Capital Gains Tax Washington State Changes In 2021 Mainsail Financial Group

Analyzing Biden S New American Families Plan Tax Proposal

What Will Be In The Biden Tax Plan Riddle Butts Llp

Capital Gains And Losses Turbotax Tax Tips Videos

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Ltcg Govt Starts Work To Bring Parity To Long Term Capital Gains Tax Laws The Economic Times

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Biden S Long Term Capital Gains Tax Increase Will Spur Selling Tek2day

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

What You Need To Know About Capital Gains Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber